Recent Transactions

$1,900,000

Finance

$1,900,000

60 Terry Road Smithtown, NY

Finance

60 Terry Road Smithtown, NY

$7,000,000

Construction Loan

$7,000,000

166-11 91st Avenue Jamaica, NY

Construction Loan

166-11 91st Avenue Jamaica, NY

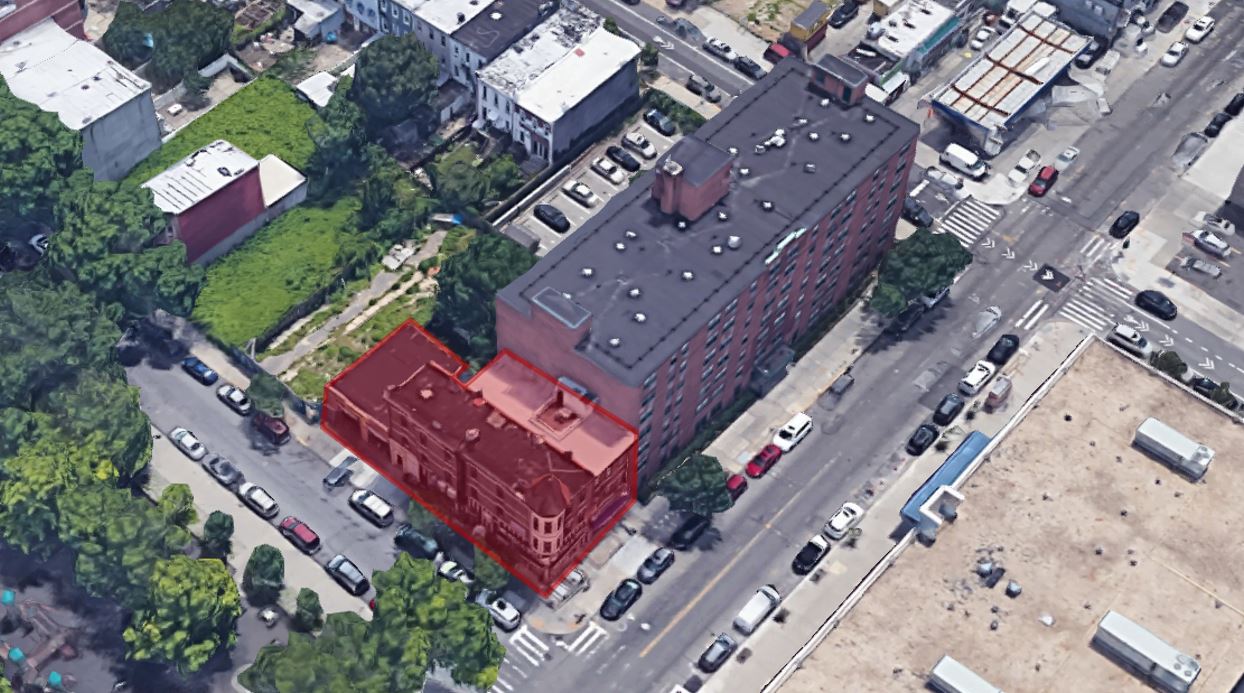

Note Sale

Note Sale

Note Sale

Hempstead, NY

Note Sale

Hempstead, NY

Note Sale

Note Sale

Note Sale

Crown Heights, NY

Note Sale

Crown Heights, NY

$4,650,000

Refinance

$4,650,000

150 W 36th Street New York, NY

Refinance

150 W 36th Street New York, NY

$7,500,000

Finance

$7,500,000

120-124 Lexington Avenue New York, NY

Finance

120-124 Lexington Avenue New York, NY

$600,000

Finance

$600,000

337-343 Merrick Road Lynbrook, NY

Finance

337-343 Merrick Road Lynbrook, NY

$16,500,000

Refinance

$16,500,000

65 & 67 Greene Street New York, NY

Refinance

65 & 67 Greene Street New York, NY

$1,300,000

Sale

$1,300,000

3037-3039 Roberts Avenue Bronx, NY

Sale

3037-3039 Roberts Avenue Bronx, NY

$499,999

Finance

$499,999

42-36 235th Street Douglaston, NY

Finance

42-36 235th Street Douglaston, NY

$2,150,000

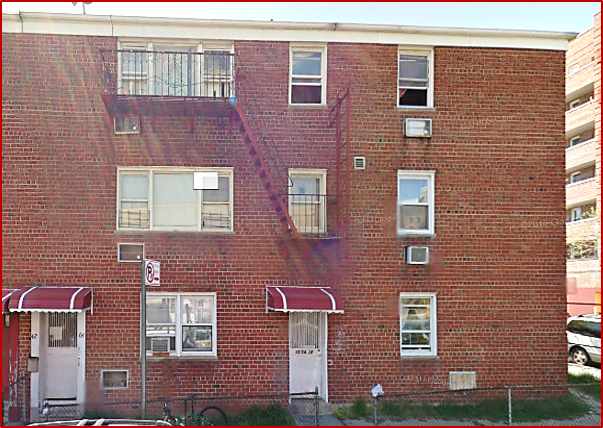

Sale

$2,150,000

54 East 182nd Street Bronx, NY

Sale

54 East 182nd Street Bronx, NY

$675,000

Finance

$675,000

358 Deer Park Avenue Babylon, NY

Finance

358 Deer Park Avenue Babylon, NY

$7,500,000

Bridge Loan

$7,500,000

501 Industry Road Staten Island, NY

Bridge Loan

501 Industry Road Staten Island, NY

$1,220,000

Sale

$1,220,000

681 West Jericho Tpke Huntington, NY

Sale

681 West Jericho Tpke Huntington, NY

$2,350,000

Sale

$2,350,000

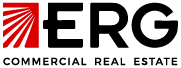

15 Locust Hill Avenue Yonkers, NY

Sale

15 Locust Hill Avenue Yonkers, NY

$800,000

Sale

$800,000

1251 Lincoln Place Brooklyn, NY

Sale

1251 Lincoln Place Brooklyn, NY

$4,550,000

Sale

$4,550,000

502 & 508 Van Cortlandt Park Avenue Yonkers, NY

Sale

502 & 508 Van Cortlandt Park Avenue Yonkers, NY

$2,500,000

Refinance/Cash Out

$2,500,000

102-110 Hempstead Tpke West Hempstead, NY

Refinance/Cash Out

102-110 Hempstead Tpke West Hempstead, NY

$425,000

Cash Out

$425,000

221 Union Avenue New Rochelle, NY

Cash Out

221 Union Avenue New Rochelle, NY

$5,000,000

Cash Out/Refinance

$5,000,000

29 Wyckoff Avenue Brooklyn, NY

Cash Out/Refinance

29 Wyckoff Avenue Brooklyn, NY

$2,250,000

Acquisition

$2,250,000

3475 Victory Boulevard Staten Island, NY

Acquisition

3475 Victory Boulevard Staten Island, NY

$2,100,000

Refinance

$2,100,000

861 & 889 Lowell Avenue Central Islip, NY

Refinance

861 & 889 Lowell Avenue Central Islip, NY

$2,435,000

Refinance

$2,435,000

570-574 North Ave & 1-15 Coligni Ave New Rochelle, NY

Refinance

570-574 North Ave & 1-15 Coligni Ave New Rochelle, NY

$2,400,000

Refinance

$2,400,000

4053 Junction Boulevard Corona, NY

Refinance

4053 Junction Boulevard Corona, NY

$1,900,000

Sale

$1,900,000

108 Grove Street Hempstead, NY

Sale

108 Grove Street Hempstead, NY

$1,850,000

Sale

$1,850,000

343 Deer Park Avenue Dix Hills, NY

Sale

343 Deer Park Avenue Dix Hills, NY

$6,000,000

Refinance

$6,000,000

23 & 27 Greenpoint Avenue Brooklyn, NY

Refinance

23 & 27 Greenpoint Avenue Brooklyn, NY

$1,000,000

Refinance

$1,000,000

670 Morris Park Avenue AKA 1743 Victor Street Bronx, NY

Refinance

670 Morris Park Avenue AKA 1743 Victor Street Bronx, NY

$980,000

Sale

$980,000

924 East 218th Street Corona, NY

Sale

924 East 218th Street Corona, NY

$775,000

Refinance

$775,000

924 East 218th Street Bronx, NY

Refinance

924 East 218th Street Bronx, NY

$755,000

Sale

$755,000

459 Montauk Highway East Moriches, NY

Sale

459 Montauk Highway East Moriches, NY

$1,500,000

Sale

$1,500,000

1589 Lakeland Avenue Bohemia, NY

Sale

1589 Lakeland Avenue Bohemia, NY

$9,000,000

Refinance/Cash Out

$9,000,000

76 Bowery Street New York, NY

Refinance/Cash Out

76 Bowery Street New York, NY

$2,700,000

Refinance

$2,700,000

255 Glen Cove Road Carle Place, NY

Refinance

255 Glen Cove Road Carle Place, NY

$1,500,000

Refinance

$1,500,000

75 W 118th Street Harlem, NY

Refinance

75 W 118th Street Harlem, NY

$725,000

Sale

$725,000

13 Glen Cove Rd Greenvale, NY

Sale

13 Glen Cove Rd Greenvale, NY

$1,000,000

Cash Out: Owner Occupied Industrial Property

$1,000,000

New Rochelle, NY

Cash Out: Owner Occupied Industrial Property

New Rochelle, NY

$1,250,000

Retail Financing with Laundromat Tenant

$1,250,000

Freeport, NY

Retail Financing with Laundromat Tenant

Freeport, NY

$3,000,000

Refinance/Cash Out: Single Tenant Warehouse

$3,000,000

Brooklyn, NY

Refinance/Cash Out: Single Tenant Warehouse

Brooklyn, NY

$875,000

Sale: 7 Day Closing

$875,000

98 S. Main Street Freeport, NY

Sale: 7 Day Closing

98 S. Main Street Freeport, NY

$1,250,000

Sale: Owner Saved from Foreclosure

$1,250,000

70-03 Myrtle Avenue Ridgewood, NY

Sale: Owner Saved from Foreclosure

70-03 Myrtle Avenue Ridgewood, NY

$1,850,000

Mixed-Use Refinance/Cash Out

$1,850,000

202 Irving Avenue & 448 Herzl Street Brooklyn, NY

Mixed-Use Refinance/Cash Out

202 Irving Avenue & 448 Herzl Street Brooklyn, NY

$825,000

Multi-Family Refinance/Cash Out

$825,000

1721 Melville Street Bronx, NY

Multi-Family Refinance/Cash Out

1721 Melville Street Bronx, NY

$1,300,000

Multi-Family Financing

$1,300,000

2076 Daly Avenue Bronx, NY

Multi-Family Financing

2076 Daly Avenue Bronx, NY

$700,000

Private Financing: Laundromat and Deli

$700,000

Long Island, NY

Private Financing: Laundromat and Deli

Long Island, NY

$1,100,000

Sale: Automotive Building & Business

$1,100,000

28-30 Sintsink Drive East Port Washington, NY

Sale: Automotive Building & Business

28-30 Sintsink Drive East Port Washington, NY

$2,400,000

Private Money Loan: Woodside Development

$2,400,000

Woodside, Queens, NY

Private Money Loan: Woodside Development

Woodside, Queens, NY

$740,000

Sale: Bronx Industrial Building

$740,000

1508 Stillwell Avenue Bronx, NY

Sale: Bronx Industrial Building

1508 Stillwell Avenue Bronx, NY

$2,490,000

Sale: Bronx Development Site

$2,490,000

2250-2258 Aqueduct Avenue Bronx, NY

Sale: Bronx Development Site

2250-2258 Aqueduct Avenue Bronx, NY

$880,000

Sale: Multifamily Foreclosure

$880,000

42-04 78th Street Elmhurst, NY

Sale: Multifamily Foreclosure

42-04 78th Street Elmhurst, NY

$9,800,000

Loan Closing

$9,800,000

1759 Middle Country Road Centereach, NY

Loan Closing

1759 Middle Country Road Centereach, NY

$3,500,000

Astoria Acquisition Loan Closing

$3,500,000

30-75 21st Street Astoria, NY

Astoria Acquisition Loan Closing

30-75 21st Street Astoria, NY

$750,000

Queens Finance Closing

$750,000

88-05 101st Avenue Ozone Park, NY

Queens Finance Closing

88-05 101st Avenue Ozone Park, NY

$2,500,000

Brooklyn Finance Closing

$2,500,000

5601 and 5603 2nd Avenue Brooklyn, NY

Brooklyn Finance Closing

5601 and 5603 2nd Avenue Brooklyn, NY

$1,100,000

Queens Sale Closing

$1,100,000

102-08 Roosevelt Avenue Corona, NY

Queens Sale Closing

102-08 Roosevelt Avenue Corona, NY

$1,500,000

Park Slope Finance Closing

$1,500,000

318 5th Avenue Park Slope, Brooklyn, NY

Park Slope Finance Closing

318 5th Avenue Park Slope, Brooklyn, NY

$4,300,000

Construction Loan Closing

$4,300,000

86-15 Rockaway Blvd Queens, NY

Construction Loan Closing

86-15 Rockaway Blvd Queens, NY

$1,400,000

Sale Closing

$1,400,000

17-21 Glen Street Glen Cove, NY

Sale Closing

17-21 Glen Street Glen Cove, NY

$1,700,000 70% LTV

Sale & Financing of Commercial Property in Yonkers

$1,700,000 70% LTV

2 Overhill Place Yonkers, NY

Sale & Financing of Commercial Property in Yonkers

2 Overhill Place Yonkers, NY

$1,700,000

Finance Closing

$1,700,000

186 Nassau Avenue Brooklyn, NY

Finance Closing

186 Nassau Avenue Brooklyn, NY

29 West Sunrise Highway Freeport, NY

Acquisition Financing

29 West Sunrise Highway Freeport, NY

$825,000

Refinance

$825,000

1243 Dean Street Brooklyn, NY

Refinance

1243 Dean Street Brooklyn, NY

$1,900,000

Refinance

$1,900,000

380 East Main Street Patchogue, NY

Refinance

380 East Main Street Patchogue, NY

$925,000

Private Financing

$925,000

Bronx & Brooklyn Portfolio

Private Financing

Bronx & Brooklyn Portfolio

$1,300,000

Private Financing

$1,300,000

211-12 Northern Boulevard Bayside, NY

Private Financing

211-12 Northern Boulevard Bayside, NY

$625,000

Refinance

$625,000

36 Bruce Avenue Yonkers, NY

Refinance

36 Bruce Avenue Yonkers, NY

$1,175,000

Sale

$1,175,000

201-03 Northern Blvd Bayside, NY

Sale

201-03 Northern Blvd Bayside, NY

$1,139,000

Refinancing

$1,139,000

20 Bonnefoy Place New Rochelle, NY

Refinancing

20 Bonnefoy Place New Rochelle, NY

$630,000

Private Financing

$630,000

1146 White Plains Road & 681 Van Nest Avenue Bronx, NY

Private Financing

1146 White Plains Road & 681 Van Nest Avenue Bronx, NY

$775,000

Private Financing

$775,000

922 Barretto Street Bronx, NY & 2 Church Tavern Road South Salem, NY

Private Financing

922 Barretto Street Bronx, NY & 2 Church Tavern Road South Salem, NY

$810,000

Refinance

$810,000

98 Bayridge Avenue Brooklyn, NY

Refinance

98 Bayridge Avenue Brooklyn, NY

$250,000

Refinance

$250,000

225 Clifton Avenue Newark, NJ

Refinance

225 Clifton Avenue Newark, NJ

$990,000

Loan Closing

$990,000

158 Main Street Huntington, NY

Loan Closing

158 Main Street Huntington, NY

$2,600,000

Sale

$2,600,000

70-17 Cooper Avenue Glendale, NY

Sale

70-17 Cooper Avenue Glendale, NY

$1,000,000

Owner Occupied Finance

$1,000,000

3766 Boston Road Bronx, NY

Owner Occupied Finance

3766 Boston Road Bronx, NY

235 West Sunrise Highway Freeport, NY

Private Financing

235 West Sunrise Highway Freeport, NY

$1,950,000

Manhattan Multifamily Sale

$1,950,000

2108-2110 2nd Avenue East Harlem, NY

Manhattan Multifamily Sale

2108-2110 2nd Avenue East Harlem, NY

$1,350,000

Long Island Industrial Building Sale

$1,350,000

2416 Chestnut Avenue Ronkonkoma, NY

Long Island Industrial Building Sale

2416 Chestnut Avenue Ronkonkoma, NY

$1,400,000

Mixed Use Portfolio Loan

$1,400,000

266 Jericho Turnpike Floral Park, NY & 414-420 Hillside Avenue New Hyde Park, NY

Mixed Use Portfolio Loan

266 Jericho Turnpike Floral Park, NY & 414-420 Hillside Avenue New Hyde Park, NY

$1,035,000

Retail Strip Center Refinance

$1,035,000

1895-1897 Wantagh Avenue Wantagh, NY

Retail Strip Center Refinance

1895-1897 Wantagh Avenue Wantagh, NY

$2,000,000

Mixed-Use Portfolio Loan

$2,000,000

40-37 76th Street & 39-18 61st Street Woodside, NY

Mixed-Use Portfolio Loan

40-37 76th Street & 39-18 61st Street Woodside, NY

$1,165,000

Newly Constructed Multifamily

$1,165,000

3839 Bronxwood Avenue Bronx, NY

Newly Constructed Multifamily

3839 Bronxwood Avenue Bronx, NY

$750,000

Brooklyn Multifamily Renovation Loan

$750,000

450 78th Street, Brooklyn, NY

Brooklyn Multifamily Renovation Loan

450 78th Street, Brooklyn, NY

$2,100,000

Mixed-Use Refinance and Cash Out

$2,100,000

140 Frost Street Williamsburg, NY

Mixed-Use Refinance and Cash Out

140 Frost Street Williamsburg, NY

$1,350,000

Mixed-Use Refinance

$1,350,000

74-30 Woodside Avenue Queens, NY

Mixed-Use Refinance

74-30 Woodside Avenue Queens, NY

$850,000

Closed: NNN Refinance Loan

$850,000

150 Hale Avenue Brooklyn, NY

Closed: NNN Refinance Loan

150 Hale Avenue Brooklyn, NY

$3,100,000

Closed: 100% Acquisition Loan

$3,100,000

57 Congers Road New City, NY

Closed: 100% Acquisition Loan

57 Congers Road New City, NY

$550,000

Financing for Acquisition

$550,000

469 South 9th Street & 138 Mount Vernon Avenue, Mount Vernon, NY

Financing for Acquisition

469 South 9th Street & 138 Mount Vernon Avenue, Mount Vernon, NY

$1,130,000

Fire Damaged Renovation Loan

$1,130,000

460 Halsey Street Brooklyn, NY

Fire Damaged Renovation Loan

460 Halsey Street Brooklyn, NY

$2,350,000

Famous Long Island Diner Refinance

$2,350,000

311 Rockaway Turnpike Lawrence, NY

Famous Long Island Diner Refinance

311 Rockaway Turnpike Lawrence, NY

$1,200,000

Gas Station Auto Body Refinance & Cash Out

$1,200,000

126th Street College Point, NY

Gas Station Auto Body Refinance & Cash Out

126th Street College Point, NY

$6,800,000

52 Unit Multifamily Refinance & Cash Out

$6,800,000

921 McLean Avenue, Yonkers, NY

52 Unit Multifamily Refinance & Cash Out

921 McLean Avenue, Yonkers, NY

$2,100,000

Manhattan Multifamily Refinance

$2,100,000

75 West 118th Street New York, NY

Manhattan Multifamily Refinance

75 West 118th Street New York, NY